ELI LILLY & (LLY)·Q4 2025 Earnings Summary

Eli Lilly Crushes Q4 as Mounjaro and Zepbound Revenues Surge 110%+

February 4, 2026 · by Fintool AI Agent

Eli Lilly delivered a blowout Q4 2025, with revenue of $19.3 billion surging 43% year-over-year and Non-GAAP EPS of $7.54 climbing 42% . The pharma giant beat consensus estimates on both the top and bottom line—revenue exceeded the $17.9B consensus by 7.5%, while EPS topped the $6.93 estimate by 8.8%. Shares jumped 7.3% in after-hours trading to $1,076 as investors cheered the accelerating incretin franchise.

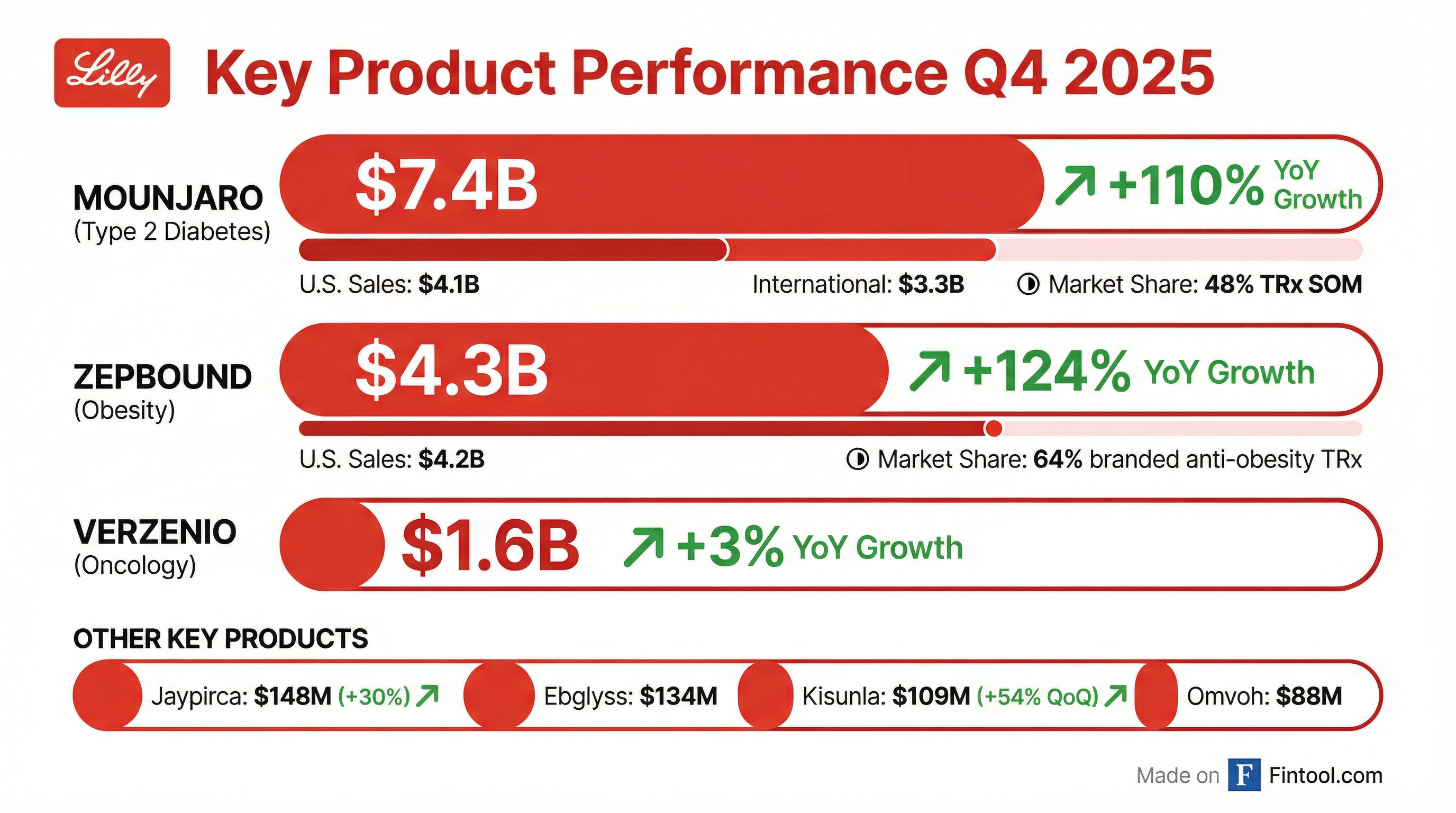

The quarter was powered by explosive growth from Lilly's GLP-1 drugs: Mounjaro (tirzepatide for type 2 diabetes) generated $7.4B (+110% YoY), while Zepbound (tirzepatide for obesity) contributed $4.3B (+124% YoY) . Lilly now commands 60.5% of the U.S. incretin analogs market, up 2.6 percentage points sequentially .

Did Eli Lilly Beat Earnings?

Yes—decisively. Lilly delivered double-digit beats on both revenue and EPS:

*Values retrieved from S&P Global

This marks Lilly's 8th consecutive quarter of revenue beats, cementing its position as the dominant force in the GLP-1 space.

Beat/Miss History (Last 8 Quarters)

*Values retrieved from S&P Global

How Did the Stock React?

Lilly shares closed at $1,003.46 on February 3rd (down 3.6% ahead of earnings) but surged 7.3% in after-hours trading to $1,076.45 following the results.

Key context:

- 52-week high: $1,133.95

- 52-week low: $623.78

- Current market cap: ~$900 billion

- YTD 2025 return: +66% (outperforming XLV healthcare ETF by 52pp)

The after-hours pop reflects investor enthusiasm for the combination of the earnings beat plus robust 2026 guidance that implies continued momentum.

What Did Management Guide?

Lilly raised the bar for 2026 with guidance that significantly exceeded prior Street expectations:

Guidance Catalysts

Favorable factors management cited :

- Continued Mounjaro and Zepbound momentum worldwide

- Medicare obesity drug coverage expected by July 1, 2026

- Growth from newer products (Ebglyss, Omvoh, Jaypirca, Kisunla)

- Orforglipron U.S. launch expected in Q2 2026 (pending FDA approval)

Headwinds to watch :

- Global pricing decline in low- to mid-teens driven by:

- U.S. government access agreement

- New Zepbound direct-to-patient pricing

- Mounjaro reimbursement in China

- Medicaid MFN pricing impact on legacy products

- Flat or eroding contributions from Taltz, Trulicity, and Verzenio

- Accelerating R&D expense growth

What Changed From Last Quarter?

Incretin Dominance Accelerating

The U.S. incretin analogs market grew 33% in Q4 vs. prior year and 6% sequentially. Lilly's share increased to 60.5%, up 2.6 percentage points from Q3 . This represents continued share gains against Novo Nordisk's Ozempic/Wegovy franchise.

Manufacturing Investments Ramping

Lilly announced new manufacturing investments in:

- Huntsville, Alabama

- Lehigh Valley, Pennsylvania

- The Netherlands

Full-year 2025 capital investments reached $7.8 billion, up 55% YoY . This aggressive capacity build-out aims to eliminate the supply constraints that have plagued Zepbound availability.

Pipeline Progress

Major Phase 3 readouts this quarter :

- Retatrutide (GIP/GLP-1/glucagon triple agonist): Positive topline data in knee osteoarthritis pain and obesity—showed 28.7% weight loss and 74% improvement in pain scores

- Orforglipron (oral GLP-1): Positive maintenance data showing patients switching from injectables maintained weight loss

- Pirtobrutinib (Jaypirca): 80% reduction in progression risk vs. bendamustine-rituximab in treatment-naïve CLL

Key Product Performance

Mounjaro (Tirzepatide for Type 2 Diabetes)

Zepbound (Tirzepatide for Obesity)

Notable: Zepbound vials (available through LillyDirect at lower price points) now represent approximately one-third of total prescriptions and nearly half of new prescriptions—a major validation of Lilly's direct-to-consumer strategy .

Other Key Products

Financial Trends (8 Quarters)

Q4 2025 added: Revenue $19.3B, Gross Margin 83.2% (Non-GAAP), Performance Margin 47.2% .

Capital Allocation

Lilly's FY 2025 capital deployment priorities :

Pipeline Catalysts for 2026

Key milestones to watch :

Regulatory Actions Expected:

- Orforglipron (oral GLP-1) for obesity — U.S. approval decision

- Tirzepatide for cardiovascular outcomes — label expansion

- Insulin efsitora alfa — once-weekly basal insulin for T2D

- Pirtobrutinib for first-line CLL

Phase 3 Data Readouts:

- Retatrutide for obesity (TRIUMPH 1/2/3 trials)

- Retatrutide for type 2 diabetes (TRANSCEND trials)

- Orforglipron for obstructive sleep apnea

- Orforglipron for T2D (ACHIEVE-4)

Phase 3 Initiations:

- Eloralintide (amylin analog) for obesity

- Sofetabart Mipitecan (FRα ADC) for ovarian cancer

- Brenipatide for major depressive disorder

Q&A Highlights: What Management Said

On Orforglipron Launch Strategy

Ken Custer (President, Cardiometabolic Health) on success factors for the oral GLP-1 launch:

"We're very encouraged by what we're seeing with oral Wegovy, as it validates our belief that there's a substantial number of people with overweight and obesity who've been sitting on the sidelines waiting for an oral option. It looks like these are mostly new starts. That means it's expanding the market, and that's good news for Lilly."

"Our profile, which is simple, with no restrictions on food and water intake, could make a big difference in the real world."

Ilya Yuffa (President, Lilly USA) on pricing: Orforglipron will launch with an entry price similar to oral competitor (~$7 range), positioned for market expansion .

On Medicare Obesity Coverage

Dave Ricks (CEO) compared the upcoming Medicare obesity demonstration to the successful insulin $35 copay program:

"Arriving at a relatively low out-of-pocket is an important fact by itself... Seniors are using these drugs at a lower rate than the general population, maybe because income, in particular, will benefit from that lower cost every month of $50."

"Like the insulin deal, it's open to all innovators... I believe, and I know that CMS does as well, that within a few years, we'll demonstrate significant cost savings to the Medicare program."

On Direct-to-Consumer Platform

Lilly disclosed that over 1 million patients are now engaging with LillyDirect in the U.S. . The Zepbound Self-Pay Vials offering now makes up:

- ~1/3 of total Zepbound prescriptions

- ~50% of new Zepbound prescriptions

This validates the company's bet on direct consumer channels and lower price points driving volume.

On International Mounjaro Mix

Patrik Johnson (President, Lilly International) noted that OUS Mounjaro business is now:

- 75% chronic weight management (mostly out-of-pocket)

- 25% type 2 diabetes (reimbursed)

- Only 9 countries with T2D reimbursement (including China as of January 2026)

On Pipeline Optionality

Ken Custer on the Aloralintide (amylin analog) opportunity:

"We were really excited about the data we shared at Obesity last week, where patients achieved up to 20.1% weight loss for Aloralintide, with excellent tolerability that was improved with titration. In fact, in the three, six, nine milligram titration group, I think we only had one incidence of vomiting out of more than 50 patients."

This positions Aloralintide as an option for the 5-10% of patients who can't tolerate incretins, plus potential for combination therapy.

Key Takeaways

- Blowout quarter: 43% revenue growth and 42% EPS growth demonstrate the power of Lilly's incretin franchise

- Market share gains: 60.5% of U.S. incretin market, up 2.6pp QoQ—widening the gap vs. Novo Nordisk

- 2026 setup is strong: Guidance implies 25% revenue growth with multiple catalysts including orforglipron launch and Medicare obesity coverage

- Pipeline optionality: Retatrutide (triple agonist) and orforglipron (oral) create multiple shots on goal beyond Mounjaro/Zepbound

- Manufacturing buildout: $7.8B in 2025 capex should ease supply constraints that limited Zepbound availability

The key risk remains pricing pressure from the U.S. government access agreement and direct-to-patient pricing, which management flagged as a low- to mid-teens headwind. However, the volume growth story appears more than sufficient to offset these dynamics.

Analysis based on Eli Lilly Q4 2025 earnings presentation published February 4, 2026. Market data as of February 4, 2026.